Display Title

Definition--Financial Literacy--Capital Loss

Display Title

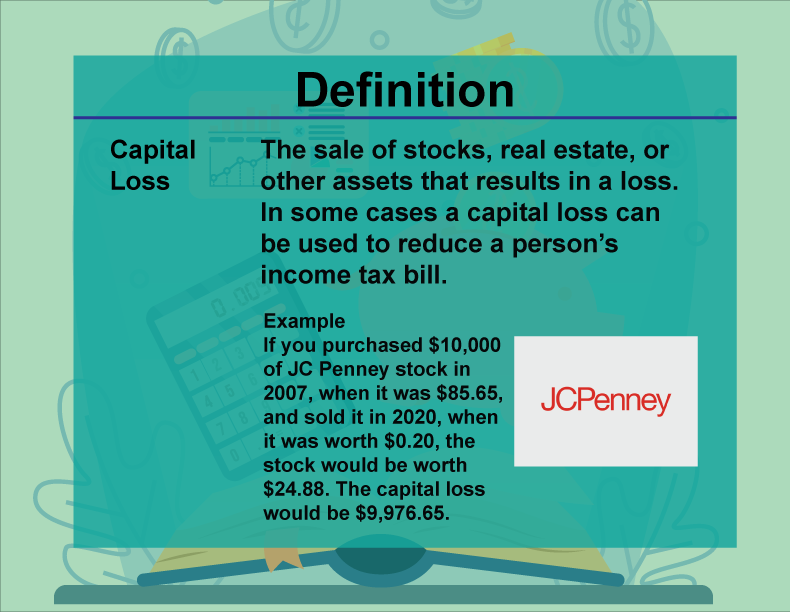

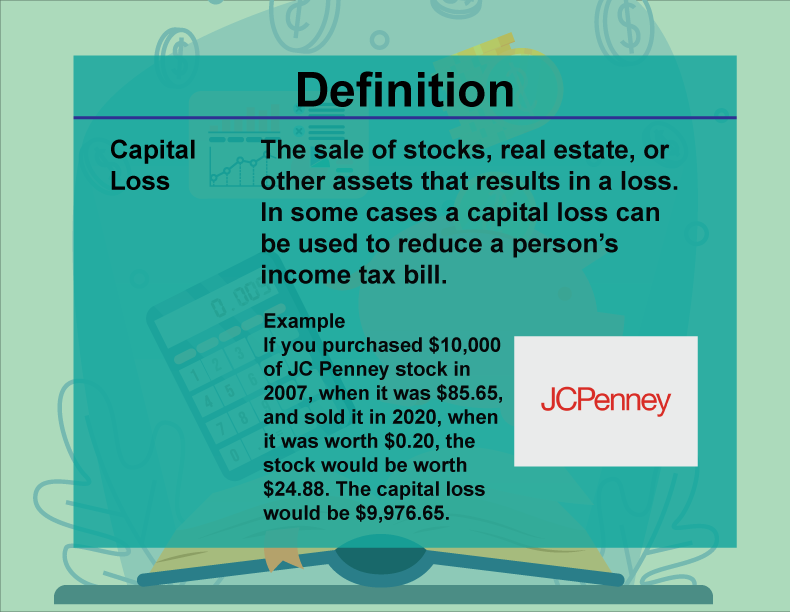

Capital Loss

Topic

Financial Literacy

Definition

A capital loss is the loss incurred when a capital asset decreases in value compared to its purchase price.

Description

Capital loss occurs when an asset is sold for less than its purchase price, impacting an individual's or business's financial position. It can be used to offset capital gains, reducing overall tax liability. Understanding capital loss is important for tax planning and investment strategies. In real-world applications, investors may strategically sell underperforming assets to realize losses that can offset gains. Algebraically, the capital loss is the difference between the purchase price and the selling price when the latter is lower. In math education, this concept helps students understand loss management and strategic financial planning. A teacher might say, "If you sell an asset for less than you bought it, that's a capital loss, and it can help reduce your taxes."

For a complete collection of terms related to Financial Literacy click on this link: Financial Literacy Collection.

| Common Core Standards | CCSS.MATH.CONTENT.HSA.CED.A.1 |

|---|---|

| Grade Range | 8 - 10 |

| Curriculum Nodes |

Algebra • Expressions, Equations, and Inequalities • Numerical and Algebraic Expressions |

| Copyright Year | 2023 |

| Keywords | financial literacy, capital, Capital Gains Tax, Capital Loss |