Display Title

Definition--Financial Literacy--Compound Interest 1

Display Title

Compound Interest 1

Topic

Financial Literacy

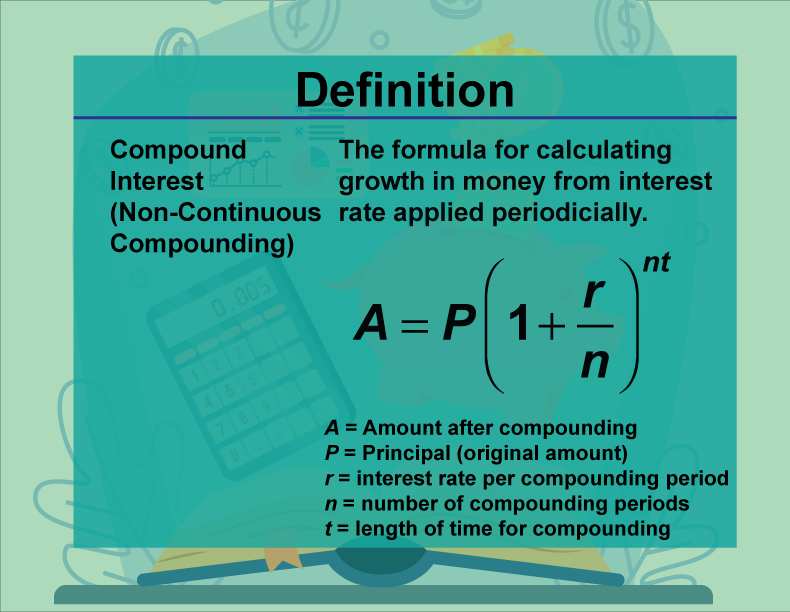

Definition

Compound interest is the addition of interest to the principal sum of a loan or deposit, where interest is calculated on the initial principal and also on the accumulated interest from previous periods.

Description

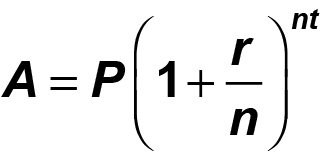

Compound interest is a powerful financial concept where interest is calculated on both the initial principal and the accumulated interest, leading to exponential growth over time. It is commonly used in savings accounts, loans, and investments. Understanding compound interest is crucial for financial planning, as it affects savings growth and loan costs. In real-world applications, compound interest can significantly increase the value of investments over time. Algebraically, the formula for compound interest is

where A is the amount, P is the principal, r is the interest rate, n is the number of times interest is compounded per year, and t t is the time in years. In math education, this concept teaches students about exponential functions and financial growth. A teacher might say, "Compound interest helps your money grow faster because you earn interest on both your savings and the interest it earns."

For a complete collection of terms related to Financial Literacy click on this link: Financial Literacy Collection.

| Common Core Standards | CCSS.MATH.CONTENT.HSA.CED.A.1 |

|---|---|

| Grade Range | 8 - 10 |

| Curriculum Nodes |

Algebra • Expressions, Equations, and Inequalities • Numerical and Algebraic Expressions |

| Copyright Year | 2023 |

| Keywords | financial literacy, interest, compound interest |