Display Title

Definition--Financial Literacy--Tax Deduction

Display Title

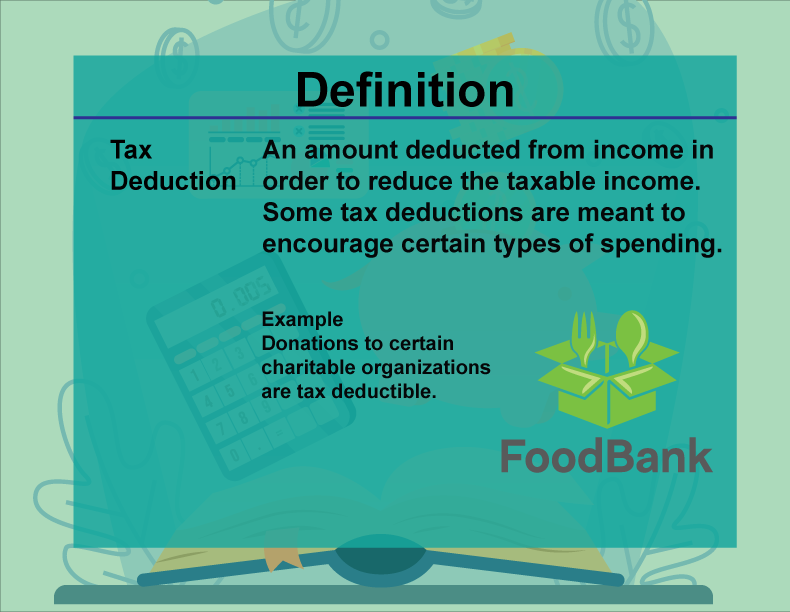

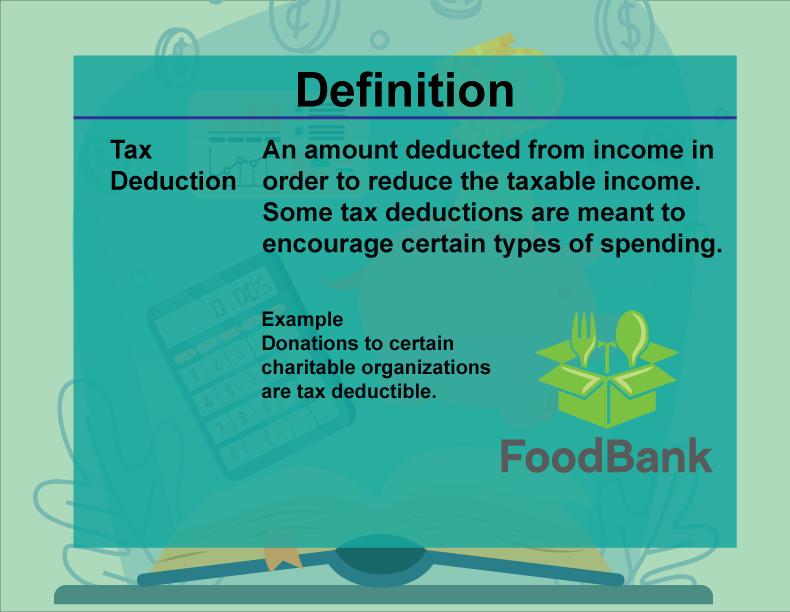

Tax Deduction

Topic

Financial Literacy

Definition

A tax deduction is an expense that can be subtracted from gross income to reduce the amount of income that is subject to tax.

Description

Tax deductions lower taxable income, reducing the overall tax burden for individuals and businesses. Understanding tax deductions is essential for effective tax planning and compliance. In real-world applications, deductions can include expenses such as mortgage interest, charitable contributions, and business expenses. Math education helps students understand how deductions impact taxable income and financial planning. A teacher might explain, "A tax deduction reduces your taxable income, which can lower the amount of tax you have to pay."

For a complete collection of terms related to Financial Literacy click on this link: Financial Literacy Collection.

| Common Core Standards | CCSS.MATH.CONTENT.HSA.CED.A.1 |

|---|---|

| Grade Range | 8 - 10 |

| Curriculum Nodes |

Algebra • Expressions, Equations, and Inequalities • Numerical and Algebraic Expressions |

| Copyright Year | 2023 |

| Keywords | financial literacy, tax, taxable income, tax deduction, tax credit, income tax, taxes |