Display Title

Math Example--Math of Money--Calculating Tax--Example 2

Display Title

Math Example--Math of Money--Calculating Tax--Example 2

Topic

The Math of Money

Description

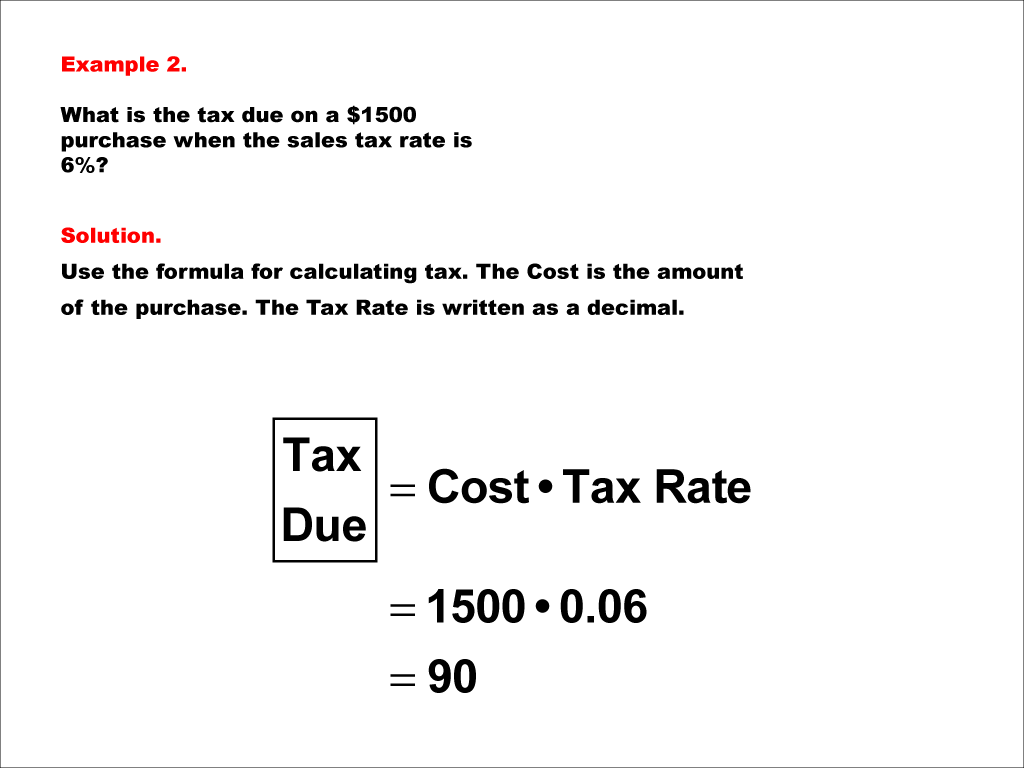

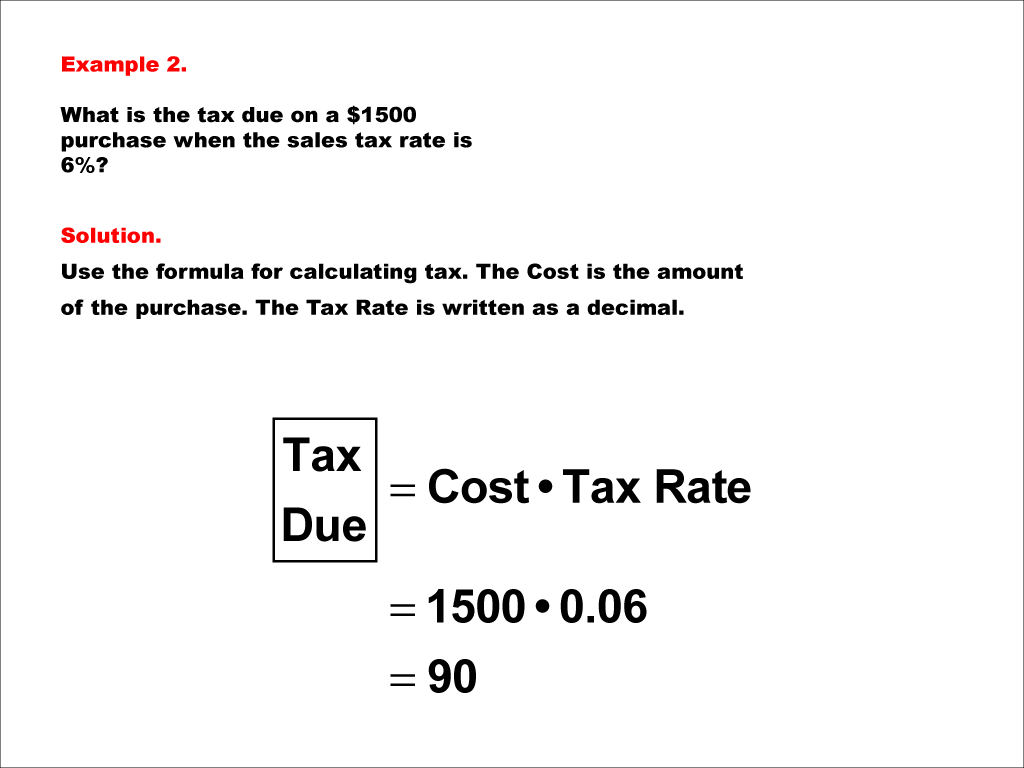

What is the tax due on a $1500 purchase when the sales tax rate is 6%? The example shows how to apply the formula Tax Due = Cost * Tax Rate.

Calculating tax is a fundamental skill in understanding financial literacy. This example and others like it help illustrate how percentages are applied in real-world scenarios, such as shopping and services.

Seeing multiple worked-out examples allows students to recognize patterns and reinforce their understanding of applying formulas consistently in various contexts. It ensures they can adapt to different numbers and situations.

Teacher Script: Let's go over this example together. We're calculating the tax due for a purchase of a specific amount with a given tax rate. Remember, we use the formula Tax Due = Cost * Tax Rate. For instance, in this example, if the purchase is $1500 and the tax rate is 6%, we compute by multiplying the cost by the tax rate expressed as a decimal (0.06). This gives us the tax due. Practice this approach to become confident.

For a complete collection of math examples related to The Math of Money click on this link: Math Examples: Calculating Tax Collection.

| Common Core Standards | CCSS.MATH.CONTENT.7.RP.A.3 |

|---|---|

| Grade Range | 6 - 8 |

| Curriculum Nodes |

Algebra • Ratios, Proportions, and Percents • Percents |

| Copyright Year | 2021 |

| Keywords | percent change, percent increase, calculating tax, math of money |