Illustrative Math Alignment: Grade 7 Unit 9

Putting it All Together

Lesson 1: Planning Recipes

Use the following Media4Math resources with this Illustrative Math lesson.

| Thumbnail Image | Title | Body | Curriculum Topic |

|---|---|---|---|

|

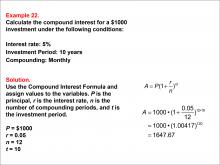

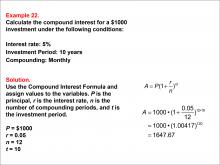

Math Example--Math of Money--Compound Interest: Example 22 | Math Example--Math of Money--Compound Interest: Example 22TopicMath of Money DescriptionThis example presents the calculation of compound interest for a $1000 investment with a 5% interest rate over 10 years, compounded monthly. Using the formula A = P(1 + r/n)nt, with P = 1000, r = 0.05, n = 12, and t = 10, the final amount is $1647.67. Understanding compound interest is crucial for financial literacy. This example demonstrates monthly compounding and its effect on investment growth compared to other frequencies. By exploring various scenarios, students learn how different compounding intervals influence financial outcomes. |

Compound Interest |

|

Math Example--Math of Money--Compound Interest: Example 22 | Math Example--Math of Money--Compound Interest: Example 22TopicMath of Money DescriptionThis example presents the calculation of compound interest for a $1000 investment with a 5% interest rate over 10 years, compounded monthly. Using the formula A = P(1 + r/n)nt, with P = 1000, r = 0.05, n = 12, and t = 10, the final amount is $1647.67. Understanding compound interest is crucial for financial literacy. This example demonstrates monthly compounding and its effect on investment growth compared to other frequencies. By exploring various scenarios, students learn how different compounding intervals influence financial outcomes. |

Compound Interest |

|

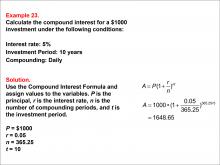

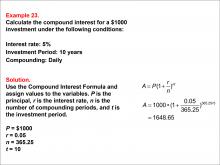

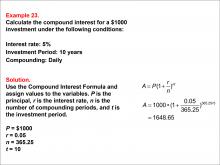

Math Example--Math of Money--Compound Interest: Example 23 | Math Example--Math of Money--Compound Interest: Example 23TopicMath of Money DescriptionThis example illustrates calculating compound interest for a $1000 investment with a 5% interest rate over 10 years, compounded daily. Using the formula A = P(1 + r/n)nt, with P = 1000, r = 0.05, n = 365.25, and t = 10, the result is $1648.65. Understanding compound interest is essential for financial literacy. This example demonstrates daily compounding and its effect on investment growth compared to other frequencies. By exploring various scenarios, students learn how different compounding intervals influence financial outcomes. |

Compound Interest |

|

Math Example--Math of Money--Compound Interest: Example 23 | Math Example--Math of Money--Compound Interest: Example 23TopicMath of Money DescriptionThis example illustrates calculating compound interest for a $1000 investment with a 5% interest rate over 10 years, compounded daily. Using the formula A = P(1 + r/n)nt, with P = 1000, r = 0.05, n = 365.25, and t = 10, the result is $1648.65. Understanding compound interest is essential for financial literacy. This example demonstrates daily compounding and its effect on investment growth compared to other frequencies. By exploring various scenarios, students learn how different compounding intervals influence financial outcomes. |

Compound Interest |

|

Math Example--Math of Money--Compound Interest: Example 23 | Math Example--Math of Money--Compound Interest: Example 23TopicMath of Money DescriptionThis example illustrates calculating compound interest for a $1000 investment with a 5% interest rate over 10 years, compounded daily. Using the formula A = P(1 + r/n)nt, with P = 1000, r = 0.05, n = 365.25, and t = 10, the result is $1648.65. Understanding compound interest is essential for financial literacy. This example demonstrates daily compounding and its effect on investment growth compared to other frequencies. By exploring various scenarios, students learn how different compounding intervals influence financial outcomes. |

Compound Interest |

|

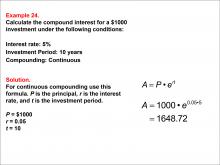

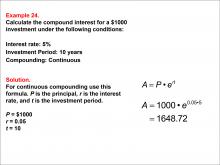

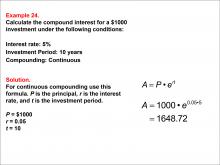

Math Example--Math of Money--Compound Interest: Example 24 | Math Example--Math of Money--Compound Interest: Example 24TopicMath of Money DescriptionThis example shows calculating compound interest for a $1000 investment with a 5% interest rate, compounded continuously over 10 years. The formula used is A = Pert. Given P = 1000, r = 0.05, and t = 10, the calculation results in $1648.72. Understanding compound interest is crucial for financial literacy. This example demonstrates continuous compounding and its effect on investment growth compared to other frequencies. By exploring various scenarios, students learn how different compounding intervals influence financial outcomes. |

Compound Interest |

|

Math Example--Math of Money--Compound Interest: Example 24 | Math Example--Math of Money--Compound Interest: Example 24TopicMath of Money DescriptionThis example shows calculating compound interest for a $1000 investment with a 5% interest rate, compounded continuously over 10 years. The formula used is A = Pert. Given P = 1000, r = 0.05, and t = 10, the calculation results in $1648.72. Understanding compound interest is crucial for financial literacy. This example demonstrates continuous compounding and its effect on investment growth compared to other frequencies. By exploring various scenarios, students learn how different compounding intervals influence financial outcomes. |

Compound Interest |

|

Math Example--Math of Money--Compound Interest: Example 24 | Math Example--Math of Money--Compound Interest: Example 24TopicMath of Money DescriptionThis example shows calculating compound interest for a $1000 investment with a 5% interest rate, compounded continuously over 10 years. The formula used is A = Pert. Given P = 1000, r = 0.05, and t = 10, the calculation results in $1648.72. Understanding compound interest is crucial for financial literacy. This example demonstrates continuous compounding and its effect on investment growth compared to other frequencies. By exploring various scenarios, students learn how different compounding intervals influence financial outcomes. |

Compound Interest |

|

Math Example--Math of Money--Compound Interest: Example 3 | Math Example--Math of Money--Compound Interest: Example 3TopicMath of Money DescriptionThis example demonstrates the calculation of compound interest for a $1000 investment at a 2.5% interest rate over 5 years, compounded quarterly. The formula A = P(1 + r/n)nt is used, where P = 1000, r = 0.025, n = 4, and t = 5. The resulting amount after 5 years is $1132.71. |

Compound Interest |

|

Math Example--Math of Money--Compound Interest: Example 3 | Math Example--Math of Money--Compound Interest: Example 3TopicMath of Money DescriptionThis example demonstrates the calculation of compound interest for a $1000 investment at a 2.5% interest rate over 5 years, compounded quarterly. The formula A = P(1 + r/n)nt is used, where P = 1000, r = 0.025, n = 4, and t = 5. The resulting amount after 5 years is $1132.71. |

Compound Interest |

|

Math Example--Math of Money--Compound Interest: Example 3 | Math Example--Math of Money--Compound Interest: Example 3TopicMath of Money DescriptionThis example demonstrates the calculation of compound interest for a $1000 investment at a 2.5% interest rate over 5 years, compounded quarterly. The formula A = P(1 + r/n)nt is used, where P = 1000, r = 0.025, n = 4, and t = 5. The resulting amount after 5 years is $1132.71. |

Compound Interest |

|

Math Example--Math of Money--Compound Interest: Example 4 | Math Example--Math of Money--Compound Interest: Example 4TopicMath of Money DescriptionThis example illustrates the calculation of compound interest for a $1000 investment at a 2.5% interest rate over 5 years, compounded monthly. The formula A = P(1 + r/n)nt is applied with P = 1000, r = 0.025, n = 12, and t = 5. The final amount after 5 years is $1132.78. |

Compound Interest |

|

Math Example--Math of Money--Compound Interest: Example 4 | Math Example--Math of Money--Compound Interest: Example 4TopicMath of Money DescriptionThis example illustrates the calculation of compound interest for a $1000 investment at a 2.5% interest rate over 5 years, compounded monthly. The formula A = P(1 + r/n)nt is applied with P = 1000, r = 0.025, n = 12, and t = 5. The final amount after 5 years is $1132.78. |

Compound Interest |

|

Math Example--Math of Money--Compound Interest: Example 4 | Math Example--Math of Money--Compound Interest: Example 4TopicMath of Money DescriptionThis example illustrates the calculation of compound interest for a $1000 investment at a 2.5% interest rate over 5 years, compounded monthly. The formula A = P(1 + r/n)nt is applied with P = 1000, r = 0.025, n = 12, and t = 5. The final amount after 5 years is $1132.78. |

Compound Interest |

|

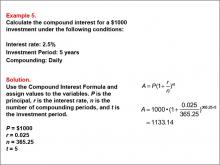

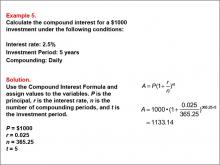

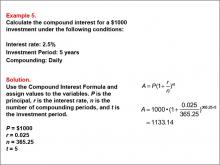

Math Example--Math of Money--Compound Interest: Example 5 | Math Example--Math of Money--Compound Interest: Example 5TopicMath of Money DescriptionThis example demonstrates the calculation of compound interest for a $1000 investment at a 2.5% interest rate over 5 years, compounded daily. The formula A = P(1 + r/n)nt is used, where P = 1000, r = 0.025, n = 365.25, and t = 5. The resulting amount after 5 years is $1133.14. |

Compound Interest |

|

Math Example--Math of Money--Compound Interest: Example 5 | Math Example--Math of Money--Compound Interest: Example 5TopicMath of Money DescriptionThis example demonstrates the calculation of compound interest for a $1000 investment at a 2.5% interest rate over 5 years, compounded daily. The formula A = P(1 + r/n)nt is used, where P = 1000, r = 0.025, n = 365.25, and t = 5. The resulting amount after 5 years is $1133.14. |

Compound Interest |

|

Math Example--Math of Money--Compound Interest: Example 5 | Math Example--Math of Money--Compound Interest: Example 5TopicMath of Money DescriptionThis example demonstrates the calculation of compound interest for a $1000 investment at a 2.5% interest rate over 5 years, compounded daily. The formula A = P(1 + r/n)nt is used, where P = 1000, r = 0.025, n = 365.25, and t = 5. The resulting amount after 5 years is $1133.14. |

Compound Interest |

|

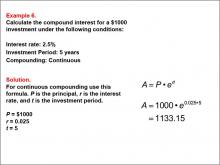

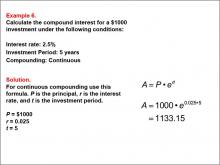

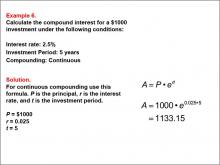

Math Example--Math of Money--Compound Interest: Example 6 | Math Example--Math of Money--Compound Interest: Example 6TopicMath of Money DescriptionThis example demonstrates the calculation of compound interest for a $1000 investment at a 2.5% interest rate, compounded continuously over 5 years. Using the formula A = P•ert, where P = 1000, r = 0.025, and t = 5, the final amount is calculated as $1133.15. |

Compound Interest |

|

Math Example--Math of Money--Compound Interest: Example 6 | Math Example--Math of Money--Compound Interest: Example 6TopicMath of Money DescriptionThis example demonstrates the calculation of compound interest for a $1000 investment at a 2.5% interest rate, compounded continuously over 5 years. Using the formula A = P•ert, where P = 1000, r = 0.025, and t = 5, the final amount is calculated as $1133.15. |

Compound Interest |

|

Math Example--Math of Money--Compound Interest: Example 6 | Math Example--Math of Money--Compound Interest: Example 6TopicMath of Money DescriptionThis example demonstrates the calculation of compound interest for a $1000 investment at a 2.5% interest rate, compounded continuously over 5 years. Using the formula A = P•ert, where P = 1000, r = 0.025, and t = 5, the final amount is calculated as $1133.15. |

Compound Interest |

|

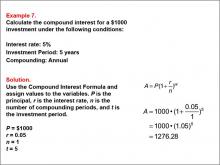

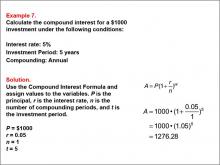

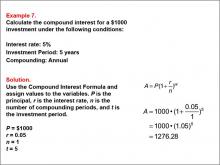

Math Example--Math of Money--Compound Interest: Example 7 | Math Example--Math of Money--Compound Interest: Example 7TopicMath of Money DescriptionThis example calculates compound interest for a $1000 investment with a 5% annual interest rate over 5 years, compounded annually. Using the formula A = P(1 + r/n)nt, where P = 1000, r = 0.05, n = 1, and t = 5, the final amount is $1276.28. Compound interest is essential in understanding how investments grow over time. This example emphasizes annual compounding and its effects on investment returns. By examining different compounding frequencies, students can appreciate how often interest is applied impacts overall growth. |

Compound Interest |

|

Math Example--Math of Money--Compound Interest: Example 7 | Math Example--Math of Money--Compound Interest: Example 7TopicMath of Money DescriptionThis example calculates compound interest for a $1000 investment with a 5% annual interest rate over 5 years, compounded annually. Using the formula A = P(1 + r/n)nt, where P = 1000, r = 0.05, n = 1, and t = 5, the final amount is $1276.28. Compound interest is essential in understanding how investments grow over time. This example emphasizes annual compounding and its effects on investment returns. By examining different compounding frequencies, students can appreciate how often interest is applied impacts overall growth. |

Compound Interest |

|

Math Example--Math of Money--Compound Interest: Example 7 | Math Example--Math of Money--Compound Interest: Example 7TopicMath of Money DescriptionThis example calculates compound interest for a $1000 investment with a 5% annual interest rate over 5 years, compounded annually. Using the formula A = P(1 + r/n)nt, where P = 1000, r = 0.05, n = 1, and t = 5, the final amount is $1276.28. Compound interest is essential in understanding how investments grow over time. This example emphasizes annual compounding and its effects on investment returns. By examining different compounding frequencies, students can appreciate how often interest is applied impacts overall growth. |

Compound Interest |

|

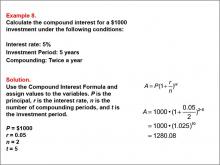

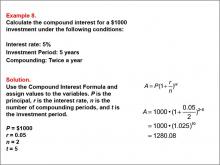

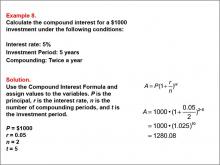

Math Example--Math of Money--Compound Interest: Example 8 | Math Example--Math of Money--Compound Interest: Example 8TopicMath of Money DescriptionThis example calculates compound interest for a $1000 investment with a 5% interest rate, compounded semi-annually over 5 years. Using the formula A = P(1 + r/n)nt, where P = 1000, r = 0.05, n = 2, and t = 5, the final amount is $1280.08. Compound interest is fundamental in financial mathematics, illustrating how investments grow over time. This example highlights semi-annual compounding, showing how different frequencies impact returns. Understanding these variations helps students grasp the practical applications of compound interest in real-life scenarios. |

Compound Interest |

|

Math Example--Math of Money--Compound Interest: Example 8 | Math Example--Math of Money--Compound Interest: Example 8TopicMath of Money DescriptionThis example calculates compound interest for a $1000 investment with a 5% interest rate, compounded semi-annually over 5 years. Using the formula A = P(1 + r/n)nt, where P = 1000, r = 0.05, n = 2, and t = 5, the final amount is $1280.08. Compound interest is fundamental in financial mathematics, illustrating how investments grow over time. This example highlights semi-annual compounding, showing how different frequencies impact returns. Understanding these variations helps students grasp the practical applications of compound interest in real-life scenarios. |

Compound Interest |

|

Math Example--Math of Money--Compound Interest: Example 8 | Math Example--Math of Money--Compound Interest: Example 8TopicMath of Money DescriptionThis example calculates compound interest for a $1000 investment with a 5% interest rate, compounded semi-annually over 5 years. Using the formula A = P(1 + r/n)nt, where P = 1000, r = 0.05, n = 2, and t = 5, the final amount is $1280.08. Compound interest is fundamental in financial mathematics, illustrating how investments grow over time. This example highlights semi-annual compounding, showing how different frequencies impact returns. Understanding these variations helps students grasp the practical applications of compound interest in real-life scenarios. |

Compound Interest |

|

Math Example--Math of Money--Compound Interest: Example 9 | Math Example--Math of Money--Compound Interest: Example 9TopicMath of Money DescriptionThis example illustrates calculating compound interest for a $1000 investment at a 5% interest rate, compounded quarterly over 5 years. The formula A = P(1 + r/n)nt is used with P = 1000, r = 0.05, n = 4, and t = 5, resulting in an amount of $1282.04. Understanding compound interest is key to financial literacy, showing how investments can grow exponentially. This example demonstrates quarterly compounding and its influence on returns. By examining different compounding intervals, students gain insight into the effects on financial growth. |

Compound Interest |

|

Math Example--Math of Money--Compound Interest: Example 9 | Math Example--Math of Money--Compound Interest: Example 9TopicMath of Money DescriptionThis example illustrates calculating compound interest for a $1000 investment at a 5% interest rate, compounded quarterly over 5 years. The formula A = P(1 + r/n)nt is used with P = 1000, r = 0.05, n = 4, and t = 5, resulting in an amount of $1282.04. Understanding compound interest is key to financial literacy, showing how investments can grow exponentially. This example demonstrates quarterly compounding and its influence on returns. By examining different compounding intervals, students gain insight into the effects on financial growth. |

Compound Interest |

|

Math Example--Math of Money--Compound Interest: Example 9 | Math Example--Math of Money--Compound Interest: Example 9TopicMath of Money DescriptionThis example illustrates calculating compound interest for a $1000 investment at a 5% interest rate, compounded quarterly over 5 years. The formula A = P(1 + r/n)nt is used with P = 1000, r = 0.05, n = 4, and t = 5, resulting in an amount of $1282.04. Understanding compound interest is key to financial literacy, showing how investments can grow exponentially. This example demonstrates quarterly compounding and its influence on returns. By examining different compounding intervals, students gain insight into the effects on financial growth. |

Compound Interest |

|

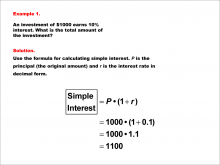

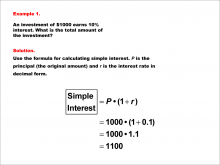

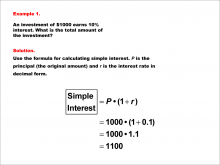

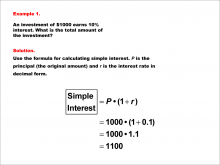

Math Example--Math of Money--Simple Interest--Example 1 | Math Example--Math of Money--Simple Interest--Example 1TopicThe Math of Money DescriptionAn investment of $1000 earns 10% interest. Calculate the total amount of the investment after applying simple interest. The solution uses the formula for simple interest: Total Amount = P * (1 + r). Substitute P = 1000 and r = 0.1 to get 1000 * (1 + 0.1) = 1000 * 1.1 = 1100. Thus, the total amount is $1100. Understanding the math of money concepts is crucial for students, as it forms the basis for financial literacy. Examples like this showcase the practical application of simple interest formulas, helping learners to connect theoretical knowledge with real-world scenarios. |

Percents |

|

Math Example--Math of Money--Simple Interest--Example 1 | Math Example--Math of Money--Simple Interest--Example 1TopicThe Math of Money DescriptionAn investment of $1000 earns 10% interest. Calculate the total amount of the investment after applying simple interest. The solution uses the formula for simple interest: Total Amount = P * (1 + r). Substitute P = 1000 and r = 0.1 to get 1000 * (1 + 0.1) = 1000 * 1.1 = 1100. Thus, the total amount is $1100. Understanding the math of money concepts is crucial for students, as it forms the basis for financial literacy. Examples like this showcase the practical application of simple interest formulas, helping learners to connect theoretical knowledge with real-world scenarios. |

Percents |

|

Math Example--Math of Money--Simple Interest--Example 1 | Math Example--Math of Money--Simple Interest--Example 1TopicThe Math of Money DescriptionAn investment of $1000 earns 10% interest. Calculate the total amount of the investment after applying simple interest. The solution uses the formula for simple interest: Total Amount = P * (1 + r). Substitute P = 1000 and r = 0.1 to get 1000 * (1 + 0.1) = 1000 * 1.1 = 1100. Thus, the total amount is $1100. Understanding the math of money concepts is crucial for students, as it forms the basis for financial literacy. Examples like this showcase the practical application of simple interest formulas, helping learners to connect theoretical knowledge with real-world scenarios. |

Percents |

|

Math Example--Math of Money--Simple Interest--Example 1 | Math Example--Math of Money--Simple Interest--Example 1TopicThe Math of Money DescriptionAn investment of $1000 earns 10% interest. Calculate the total amount of the investment after applying simple interest. The solution uses the formula for simple interest: Total Amount = P * (1 + r). Substitute P = 1000 and r = 0.1 to get 1000 * (1 + 0.1) = 1000 * 1.1 = 1100. Thus, the total amount is $1100. Understanding the math of money concepts is crucial for students, as it forms the basis for financial literacy. Examples like this showcase the practical application of simple interest formulas, helping learners to connect theoretical knowledge with real-world scenarios. |

Percents |

|

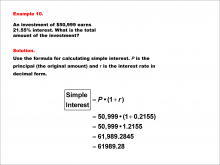

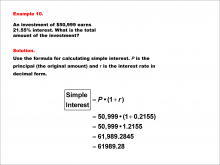

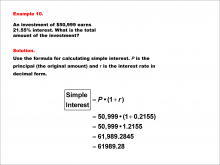

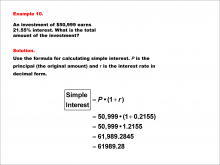

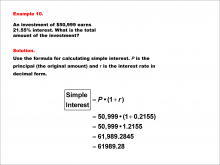

Math Example--Math of Money--Simple Interest--Example 10 | Math Example--Math of Money--Simple Interest--Example 10TopicThe Math of Money DescriptionAn investment of $50,999 earns 21.55% interest. Calculate the total amount of the investment after applying simple interest. Substitute P = 50999 and r = 0.2155 in the formula Total Amount = P * (1 + r) to get 50999 * (1 + 0.2155) = 50999 * 1.2155 ≈ 61,989.28. Thus, the total amount is approximately $61,989.28. Understanding the math of money concepts is crucial for students, as it forms the basis for financial literacy. Examples like this showcase the practical application of simple interest formulas, helping learners to connect theoretical knowledge with real-world scenarios. |

Percents |

|

Math Example--Math of Money--Simple Interest--Example 10 | Math Example--Math of Money--Simple Interest--Example 10TopicThe Math of Money DescriptionAn investment of $50,999 earns 21.55% interest. Calculate the total amount of the investment after applying simple interest. Substitute P = 50999 and r = 0.2155 in the formula Total Amount = P * (1 + r) to get 50999 * (1 + 0.2155) = 50999 * 1.2155 ≈ 61,989.28. Thus, the total amount is approximately $61,989.28. Understanding the math of money concepts is crucial for students, as it forms the basis for financial literacy. Examples like this showcase the practical application of simple interest formulas, helping learners to connect theoretical knowledge with real-world scenarios. |

Percents |

|

Math Example--Math of Money--Simple Interest--Example 10 | Math Example--Math of Money--Simple Interest--Example 10TopicThe Math of Money DescriptionAn investment of $50,999 earns 21.55% interest. Calculate the total amount of the investment after applying simple interest. Substitute P = 50999 and r = 0.2155 in the formula Total Amount = P * (1 + r) to get 50999 * (1 + 0.2155) = 50999 * 1.2155 ≈ 61,989.28. Thus, the total amount is approximately $61,989.28. Understanding the math of money concepts is crucial for students, as it forms the basis for financial literacy. Examples like this showcase the practical application of simple interest formulas, helping learners to connect theoretical knowledge with real-world scenarios. |

Percents |

|

Math Example--Math of Money--Simple Interest--Example 10 | Math Example--Math of Money--Simple Interest--Example 10TopicThe Math of Money DescriptionAn investment of $50,999 earns 21.55% interest. Calculate the total amount of the investment after applying simple interest. Substitute P = 50999 and r = 0.2155 in the formula Total Amount = P * (1 + r) to get 50999 * (1 + 0.2155) = 50999 * 1.2155 ≈ 61,989.28. Thus, the total amount is approximately $61,989.28. Understanding the math of money concepts is crucial for students, as it forms the basis for financial literacy. Examples like this showcase the practical application of simple interest formulas, helping learners to connect theoretical knowledge with real-world scenarios. |

Percents |

|

Math Example--Math of Money--Simple Interest--Example 10 | Math Example--Math of Money--Simple Interest--Example 10TopicThe Math of Money DescriptionAn investment of $50,999 earns 21.55% interest. Calculate the total amount of the investment after applying simple interest. Substitute P = 50999 and r = 0.2155 in the formula Total Amount = P * (1 + r) to get 50999 * (1 + 0.2155) = 50999 * 1.2155 ≈ 61,989.28. Thus, the total amount is approximately $61,989.28. Understanding the math of money concepts is crucial for students, as it forms the basis for financial literacy. Examples like this showcase the practical application of simple interest formulas, helping learners to connect theoretical knowledge with real-world scenarios. |

Percents |

|

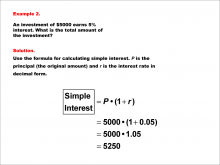

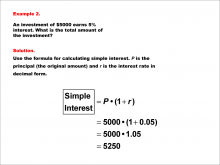

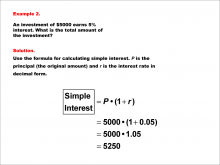

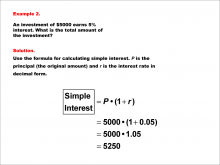

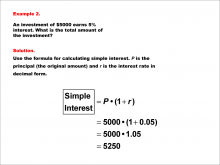

Math Example--Math of Money--Simple Interest--Example 2 | Math Example--Math of Money--Simple Interest--Example 2TopicThe Math of Money DescriptionAn investment of $5000 earns 5% interest. Calculate the total amount of the investment after applying simple interest. Using the formula Total Amount = P * (1 + r), substitute P = 5000 and r = 0.05. This gives 5000 * (1 + 0.05) = 5000 * 1.05 = 5250. Therefore, the total amount is $5250. Understanding the math of money concepts is crucial for students, as it forms the basis for financial literacy. Examples like this showcase the practical application of simple interest formulas, helping learners to connect theoretical knowledge with real-world scenarios. |

Percents |

|

Math Example--Math of Money--Simple Interest--Example 2 | Math Example--Math of Money--Simple Interest--Example 2TopicThe Math of Money DescriptionAn investment of $5000 earns 5% interest. Calculate the total amount of the investment after applying simple interest. Using the formula Total Amount = P * (1 + r), substitute P = 5000 and r = 0.05. This gives 5000 * (1 + 0.05) = 5000 * 1.05 = 5250. Therefore, the total amount is $5250. Understanding the math of money concepts is crucial for students, as it forms the basis for financial literacy. Examples like this showcase the practical application of simple interest formulas, helping learners to connect theoretical knowledge with real-world scenarios. |

Percents |

|

Math Example--Math of Money--Simple Interest--Example 2 | Math Example--Math of Money--Simple Interest--Example 2TopicThe Math of Money DescriptionAn investment of $5000 earns 5% interest. Calculate the total amount of the investment after applying simple interest. Using the formula Total Amount = P * (1 + r), substitute P = 5000 and r = 0.05. This gives 5000 * (1 + 0.05) = 5000 * 1.05 = 5250. Therefore, the total amount is $5250. Understanding the math of money concepts is crucial for students, as it forms the basis for financial literacy. Examples like this showcase the practical application of simple interest formulas, helping learners to connect theoretical knowledge with real-world scenarios. |

Percents |

|

Math Example--Math of Money--Simple Interest--Example 2 | Math Example--Math of Money--Simple Interest--Example 2TopicThe Math of Money DescriptionAn investment of $5000 earns 5% interest. Calculate the total amount of the investment after applying simple interest. Using the formula Total Amount = P * (1 + r), substitute P = 5000 and r = 0.05. This gives 5000 * (1 + 0.05) = 5000 * 1.05 = 5250. Therefore, the total amount is $5250. Understanding the math of money concepts is crucial for students, as it forms the basis for financial literacy. Examples like this showcase the practical application of simple interest formulas, helping learners to connect theoretical knowledge with real-world scenarios. |

Percents |

|

Math Example--Math of Money--Simple Interest--Example 2 | Math Example--Math of Money--Simple Interest--Example 2TopicThe Math of Money DescriptionAn investment of $5000 earns 5% interest. Calculate the total amount of the investment after applying simple interest. Using the formula Total Amount = P * (1 + r), substitute P = 5000 and r = 0.05. This gives 5000 * (1 + 0.05) = 5000 * 1.05 = 5250. Therefore, the total amount is $5250. Understanding the math of money concepts is crucial for students, as it forms the basis for financial literacy. Examples like this showcase the practical application of simple interest formulas, helping learners to connect theoretical knowledge with real-world scenarios. |

Percents |

|

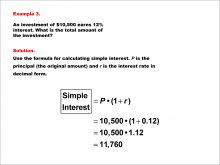

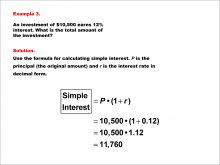

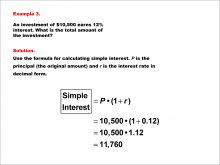

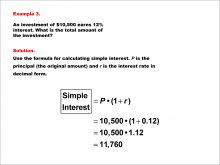

Math Example--Math of Money--Simple Interest--Example 3 | Math Example--Math of Money--Simple Interest--Example 3TopicThe Math of Money DescriptionAn investment of $10,500 earns 12% interest. Calculate the total amount of the investment after applying simple interest. Apply the formula Total Amount = P * (1 + r). With P = 10500 and r = 0.12, calculate 10500 * (1 + 0.12) = 10500 * 1.12 = 11760. So, the total amount is $11760. Understanding the math of money concepts is crucial for students, as it forms the basis for financial literacy. Examples like this showcase the practical application of simple interest formulas, helping learners to connect theoretical knowledge with real-world scenarios. |

Percents |

|

Math Example--Math of Money--Simple Interest--Example 3 | Math Example--Math of Money--Simple Interest--Example 3TopicThe Math of Money DescriptionAn investment of $10,500 earns 12% interest. Calculate the total amount of the investment after applying simple interest. Apply the formula Total Amount = P * (1 + r). With P = 10500 and r = 0.12, calculate 10500 * (1 + 0.12) = 10500 * 1.12 = 11760. So, the total amount is $11760. Understanding the math of money concepts is crucial for students, as it forms the basis for financial literacy. Examples like this showcase the practical application of simple interest formulas, helping learners to connect theoretical knowledge with real-world scenarios. |

Percents |

|

Math Example--Math of Money--Simple Interest--Example 3 | Math Example--Math of Money--Simple Interest--Example 3TopicThe Math of Money DescriptionAn investment of $10,500 earns 12% interest. Calculate the total amount of the investment after applying simple interest. Apply the formula Total Amount = P * (1 + r). With P = 10500 and r = 0.12, calculate 10500 * (1 + 0.12) = 10500 * 1.12 = 11760. So, the total amount is $11760. Understanding the math of money concepts is crucial for students, as it forms the basis for financial literacy. Examples like this showcase the practical application of simple interest formulas, helping learners to connect theoretical knowledge with real-world scenarios. |

Percents |

|

Math Example--Math of Money--Simple Interest--Example 3 | Math Example--Math of Money--Simple Interest--Example 3TopicThe Math of Money DescriptionAn investment of $10,500 earns 12% interest. Calculate the total amount of the investment after applying simple interest. Apply the formula Total Amount = P * (1 + r). With P = 10500 and r = 0.12, calculate 10500 * (1 + 0.12) = 10500 * 1.12 = 11760. So, the total amount is $11760. Understanding the math of money concepts is crucial for students, as it forms the basis for financial literacy. Examples like this showcase the practical application of simple interest formulas, helping learners to connect theoretical knowledge with real-world scenarios. |

Percents |

|

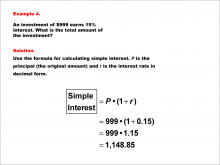

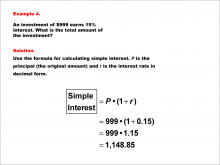

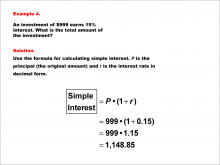

Math Example--Math of Money--Simple Interest--Example 4 | Math Example--Math of Money--Simple Interest--Example 4TopicThe Math of Money DescriptionAn investment of $999 earns 15% interest. Calculate the total amount of the investment after applying simple interest. Substitute P = 999 and r = 0.15 into the formula Total Amount = P * (1 + r), resulting in 999 * (1 + 0.15) = 999 * 1.15 = 1148.85. Therefore, the total amount is $1148.85. Understanding the math of money concepts is crucial for students, as it forms the basis for financial literacy. Examples like this showcase the practical application of simple interest formulas, helping learners to connect theoretical knowledge with real-world scenarios. |

Percents |

|

Math Example--Math of Money--Simple Interest--Example 4 | Math Example--Math of Money--Simple Interest--Example 4TopicThe Math of Money DescriptionAn investment of $999 earns 15% interest. Calculate the total amount of the investment after applying simple interest. Substitute P = 999 and r = 0.15 into the formula Total Amount = P * (1 + r), resulting in 999 * (1 + 0.15) = 999 * 1.15 = 1148.85. Therefore, the total amount is $1148.85. Understanding the math of money concepts is crucial for students, as it forms the basis for financial literacy. Examples like this showcase the practical application of simple interest formulas, helping learners to connect theoretical knowledge with real-world scenarios. |

Percents |

|

Math Example--Math of Money--Simple Interest--Example 4 | Math Example--Math of Money--Simple Interest--Example 4TopicThe Math of Money DescriptionAn investment of $999 earns 15% interest. Calculate the total amount of the investment after applying simple interest. Substitute P = 999 and r = 0.15 into the formula Total Amount = P * (1 + r), resulting in 999 * (1 + 0.15) = 999 * 1.15 = 1148.85. Therefore, the total amount is $1148.85. Understanding the math of money concepts is crucial for students, as it forms the basis for financial literacy. Examples like this showcase the practical application of simple interest formulas, helping learners to connect theoretical knowledge with real-world scenarios. |

Percents |