Illustrative Math Alignment: Grade 7 Unit 9

Putting it All Together

Lesson 4: Restaurant Floor Plan

Use the following Media4Math resources with this Illustrative Math lesson.

| Thumbnail Image | Title | Body | Curriculum Topic |

|---|---|---|---|

|

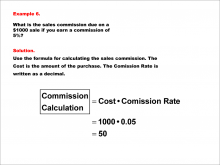

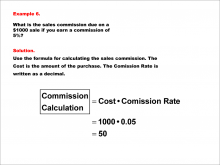

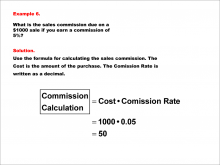

Math Example--Math of Money--Calculating Tips and Commissions--Example 6 | Math Example--Math of Money--Calculating Tips and Commissions--Example 6TopicThe Math of Money DescriptionCalculate a 5% sales commission on a $1000 sale. The problem requires finding 5% of 1000. To calculate the commission, multiply the sale amount (1000) by the commission rate (0.05). Commission = 1000 * 0.05 = 50. The answer is $50. In general, the topic "The Math of Money" covers understanding the calculation of financial metrics like tips and commissions. Examples in this collection focus on real-world scenarios where these calculations are necessary, helping students grasp the mathematical principles involved. |

Percents |

|

Math Example--Math of Money--Calculating Tips and Commissions--Example 6 | Math Example--Math of Money--Calculating Tips and Commissions--Example 6TopicThe Math of Money DescriptionCalculate a 5% sales commission on a $1000 sale. The problem requires finding 5% of 1000. To calculate the commission, multiply the sale amount (1000) by the commission rate (0.05). Commission = 1000 * 0.05 = 50. The answer is $50. In general, the topic "The Math of Money" covers understanding the calculation of financial metrics like tips and commissions. Examples in this collection focus on real-world scenarios where these calculations are necessary, helping students grasp the mathematical principles involved. |

Percents |

|

Math Example--Math of Money--Calculating Tips and Commissions--Example 6 | Math Example--Math of Money--Calculating Tips and Commissions--Example 6TopicThe Math of Money DescriptionCalculate a 5% sales commission on a $1000 sale. The problem requires finding 5% of 1000. To calculate the commission, multiply the sale amount (1000) by the commission rate (0.05). Commission = 1000 * 0.05 = 50. The answer is $50. In general, the topic "The Math of Money" covers understanding the calculation of financial metrics like tips and commissions. Examples in this collection focus on real-world scenarios where these calculations are necessary, helping students grasp the mathematical principles involved. |

Percents |

|

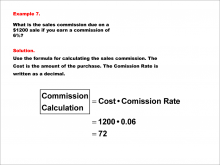

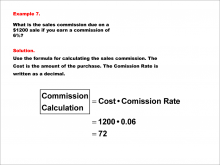

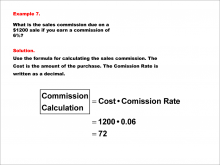

Math Example--Math of Money--Calculating Tips and Commissions--Example 7 | Math Example--Math of Money--Calculating Tips and Commissions--Example 7TopicThe Math of Money DescriptionCalculate a 6% sales commission on a $1200 sale. The problem requires finding 6% of 1200. To calculate the commission, multiply the sale amount (1200) by the commission rate (0.06). Commission = 1200 * 0.06 = 72. The answer is $72. In general, the topic "The Math of Money" covers understanding the calculation of financial metrics like tips and commissions. Examples in this collection focus on real-world scenarios where these calculations are necessary, helping students grasp the mathematical principles involved. |

Percents |

|

Math Example--Math of Money--Calculating Tips and Commissions--Example 7 | Math Example--Math of Money--Calculating Tips and Commissions--Example 7TopicThe Math of Money DescriptionCalculate a 6% sales commission on a $1200 sale. The problem requires finding 6% of 1200. To calculate the commission, multiply the sale amount (1200) by the commission rate (0.06). Commission = 1200 * 0.06 = 72. The answer is $72. In general, the topic "The Math of Money" covers understanding the calculation of financial metrics like tips and commissions. Examples in this collection focus on real-world scenarios where these calculations are necessary, helping students grasp the mathematical principles involved. |

Percents |

|

Math Example--Math of Money--Calculating Tips and Commissions--Example 7 | Math Example--Math of Money--Calculating Tips and Commissions--Example 7TopicThe Math of Money DescriptionCalculate a 6% sales commission on a $1200 sale. The problem requires finding 6% of 1200. To calculate the commission, multiply the sale amount (1200) by the commission rate (0.06). Commission = 1200 * 0.06 = 72. The answer is $72. In general, the topic "The Math of Money" covers understanding the calculation of financial metrics like tips and commissions. Examples in this collection focus on real-world scenarios where these calculations are necessary, helping students grasp the mathematical principles involved. |

Percents |

|

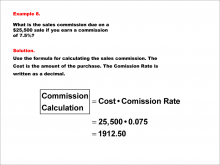

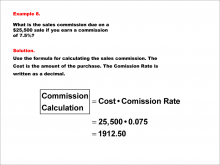

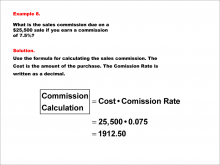

Math Example--Math of Money--Calculating Tips and Commissions--Example 8 | Math Example--Math of Money--Calculating Tips and Commissions--Example 8TopicThe Math of Money DescriptionCalculate a 7.5% sales commission on a $25,500 sale. The problem requires finding 7.5% of 25,500. To calculate the commission, multiply the sale amount (25,500) by the commission rate (0.075). Commission = 25,500 * 0.075 = 1912.50. The answer is $1,912.50. In general, the topic "The Math of Money" covers understanding the calculation of financial metrics like tips and commissions. Examples in this collection focus on real-world scenarios where these calculations are necessary, helping students grasp the mathematical principles involved. |

Percents |

|

Math Example--Math of Money--Calculating Tips and Commissions--Example 8 | Math Example--Math of Money--Calculating Tips and Commissions--Example 8TopicThe Math of Money DescriptionCalculate a 7.5% sales commission on a $25,500 sale. The problem requires finding 7.5% of 25,500. To calculate the commission, multiply the sale amount (25,500) by the commission rate (0.075). Commission = 25,500 * 0.075 = 1912.50. The answer is $1,912.50. In general, the topic "The Math of Money" covers understanding the calculation of financial metrics like tips and commissions. Examples in this collection focus on real-world scenarios where these calculations are necessary, helping students grasp the mathematical principles involved. |

Percents |

|

Math Example--Math of Money--Calculating Tips and Commissions--Example 8 | Math Example--Math of Money--Calculating Tips and Commissions--Example 8TopicThe Math of Money DescriptionCalculate a 7.5% sales commission on a $25,500 sale. The problem requires finding 7.5% of 25,500. To calculate the commission, multiply the sale amount (25,500) by the commission rate (0.075). Commission = 25,500 * 0.075 = 1912.50. The answer is $1,912.50. In general, the topic "The Math of Money" covers understanding the calculation of financial metrics like tips and commissions. Examples in this collection focus on real-world scenarios where these calculations are necessary, helping students grasp the mathematical principles involved. |

Percents |

|

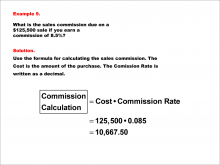

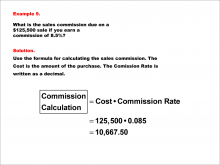

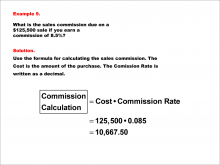

Math Example--Math of Money--Calculating Tips and Commissions--Example 9 | Math Example--Math of Money--Calculating Tips and Commissions--Example 9TopicThe Math of Money DescriptionCalculate an 8.5% sales commission on a $125,500 sale. The problem requires finding 8.5% of 125,500. To calculate the commission, multiply the sale amount (125,500) by the commission rate (0.085). Commission = 125,500 * 0.085 = 10,667.50. The answer is $10,667.50. |

Percents |

|

Math Example--Math of Money--Calculating Tips and Commissions--Example 9 | Math Example--Math of Money--Calculating Tips and Commissions--Example 9TopicThe Math of Money DescriptionCalculate an 8.5% sales commission on a $125,500 sale. The problem requires finding 8.5% of 125,500. To calculate the commission, multiply the sale amount (125,500) by the commission rate (0.085). Commission = 125,500 * 0.085 = 10,667.50. The answer is $10,667.50. |

Percents |

|

Math Example--Math of Money--Calculating Tips and Commissions--Example 9 | Math Example--Math of Money--Calculating Tips and Commissions--Example 9TopicThe Math of Money DescriptionCalculate an 8.5% sales commission on a $125,500 sale. The problem requires finding 8.5% of 125,500. To calculate the commission, multiply the sale amount (125,500) by the commission rate (0.085). Commission = 125,500 * 0.085 = 10,667.50. The answer is $10,667.50. |

Percents |

|

Math Example--Math of Money--Compound Interest: Example 1 | Math Example--Math of Money--Compound Interest: Example 1TopicMath of Money DescriptionThis example demonstrates compound interest calculation for a $1000 investment at a 2.5% interest rate over 5 years, compounded annually. Using the formula A = P(1 + r/n)nt, where P is the principal amount, r is the interest rate, n is the number of times interest is compounded per year, and t is the number of years, the final amount is calculated to be $1131.41. |

Compound Interest |

|

Math Example--Math of Money--Compound Interest: Example 1 | Math Example--Math of Money--Compound Interest: Example 1TopicMath of Money DescriptionThis example demonstrates compound interest calculation for a $1000 investment at a 2.5% interest rate over 5 years, compounded annually. Using the formula A = P(1 + r/n)nt, where P is the principal amount, r is the interest rate, n is the number of times interest is compounded per year, and t is the number of years, the final amount is calculated to be $1131.41. |

Compound Interest |

|

Math Example--Math of Money--Compound Interest: Example 1 | Math Example--Math of Money--Compound Interest: Example 1TopicMath of Money DescriptionThis example demonstrates compound interest calculation for a $1000 investment at a 2.5% interest rate over 5 years, compounded annually. Using the formula A = P(1 + r/n)nt, where P is the principal amount, r is the interest rate, n is the number of times interest is compounded per year, and t is the number of years, the final amount is calculated to be $1131.41. |

Compound Interest |

|

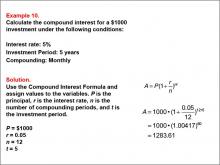

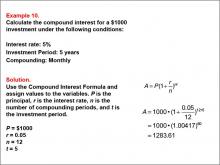

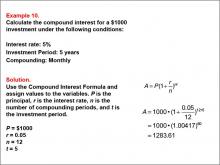

Math Example--Math of Money--Compound Interest: Example 10 | Math Example--Math of Money--Compound Interest: Example 10TopicMath of Money DescriptionThis example calculates compound interest for a $1000 investment at a 5% interest rate over 5 years, compounded monthly. Using the formula A = P(1 + r/n)nt, where P = 1000, r = 0.05, n = 12, and t = 5, the final amount is $1283.61. Compound interest is a key concept in financial mathematics that shows how investments grow over time. This example highlights monthly compounding, demonstrating the impact of more frequent compounding on returns. Understanding these differences helps students apply compound interest in real-world financial scenarios. |

Compound Interest |

|

Math Example--Math of Money--Compound Interest: Example 10 | Math Example--Math of Money--Compound Interest: Example 10TopicMath of Money DescriptionThis example calculates compound interest for a $1000 investment at a 5% interest rate over 5 years, compounded monthly. Using the formula A = P(1 + r/n)nt, where P = 1000, r = 0.05, n = 12, and t = 5, the final amount is $1283.61. Compound interest is a key concept in financial mathematics that shows how investments grow over time. This example highlights monthly compounding, demonstrating the impact of more frequent compounding on returns. Understanding these differences helps students apply compound interest in real-world financial scenarios. |

Compound Interest |

|

Math Example--Math of Money--Compound Interest: Example 10 | Math Example--Math of Money--Compound Interest: Example 10TopicMath of Money DescriptionThis example calculates compound interest for a $1000 investment at a 5% interest rate over 5 years, compounded monthly. Using the formula A = P(1 + r/n)nt, where P = 1000, r = 0.05, n = 12, and t = 5, the final amount is $1283.61. Compound interest is a key concept in financial mathematics that shows how investments grow over time. This example highlights monthly compounding, demonstrating the impact of more frequent compounding on returns. Understanding these differences helps students apply compound interest in real-world financial scenarios. |

Compound Interest |

|

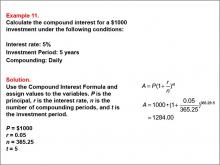

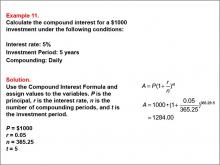

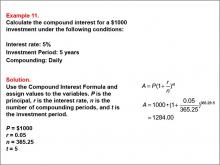

Math Example--Math of Money--Compound Interest: Example 11 | Math Example--Math of Money--Compound Interest: Example 11TopicMath of Money DescriptionThis example calculates compound interest for a $1000 investment at a 5% interest rate over 5 years, compounded daily. The formula $$A = P(1 + r/n)nt is used with P = 1000, r = 0.05, n = 365, and t = 5, resulting in an amount of $1284.00. Understanding compound interest is crucial for financial literacy. This example demonstrates daily compounding and its effect on investment growth compared to other frequencies. By exploring various scenarios, students learn how different compounding intervals influence financial outcomes. |

Compound Interest |

|

Math Example--Math of Money--Compound Interest: Example 11 | Math Example--Math of Money--Compound Interest: Example 11TopicMath of Money DescriptionThis example calculates compound interest for a $1000 investment at a 5% interest rate over 5 years, compounded daily. The formula $$A = P(1 + r/n)nt is used with P = 1000, r = 0.05, n = 365, and t = 5, resulting in an amount of $1284.00. Understanding compound interest is crucial for financial literacy. This example demonstrates daily compounding and its effect on investment growth compared to other frequencies. By exploring various scenarios, students learn how different compounding intervals influence financial outcomes. |

Compound Interest |

|

Math Example--Math of Money--Compound Interest: Example 11 | Math Example--Math of Money--Compound Interest: Example 11TopicMath of Money DescriptionThis example calculates compound interest for a $1000 investment at a 5% interest rate over 5 years, compounded daily. The formula $$A = P(1 + r/n)nt is used with P = 1000, r = 0.05, n = 365, and t = 5, resulting in an amount of $1284.00. Understanding compound interest is crucial for financial literacy. This example demonstrates daily compounding and its effect on investment growth compared to other frequencies. By exploring various scenarios, students learn how different compounding intervals influence financial outcomes. |

Compound Interest |

|

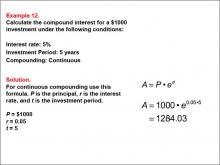

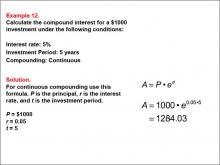

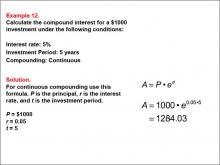

Math Example--Math of Money--Compound Interest: Example 12 | Math Example--Math of Money--Compound Interest: Example 12TopicMath of Money DescriptionThis example calculates compound interest for a $1000 investment at a 5% interest rate over 5 years, compounded continuously. Using the formula A = Pert, where P = 1000, r = 0.05, and t = 5, the final amount is $1284.03. Compound interest is a fundamental concept in finance, illustrating how investments grow exponentially over time. This example highlights continuous compounding, which shows the impact of applying interest at every possible moment. Understanding these differences helps students apply compound interest in real-world financial scenarios. |

Compound Interest |

|

Math Example--Math of Money--Compound Interest: Example 12 | Math Example--Math of Money--Compound Interest: Example 12TopicMath of Money DescriptionThis example calculates compound interest for a $1000 investment at a 5% interest rate over 5 years, compounded continuously. Using the formula A = Pert, where P = 1000, r = 0.05, and t = 5, the final amount is $1284.03. Compound interest is a fundamental concept in finance, illustrating how investments grow exponentially over time. This example highlights continuous compounding, which shows the impact of applying interest at every possible moment. Understanding these differences helps students apply compound interest in real-world financial scenarios. |

Compound Interest |

|

Math Example--Math of Money--Compound Interest: Example 12 | Math Example--Math of Money--Compound Interest: Example 12TopicMath of Money DescriptionThis example calculates compound interest for a $1000 investment at a 5% interest rate over 5 years, compounded continuously. Using the formula A = Pert, where P = 1000, r = 0.05, and t = 5, the final amount is $1284.03. Compound interest is a fundamental concept in finance, illustrating how investments grow exponentially over time. This example highlights continuous compounding, which shows the impact of applying interest at every possible moment. Understanding these differences helps students apply compound interest in real-world financial scenarios. |

Compound Interest |

|

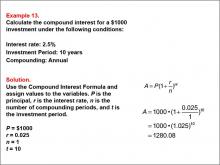

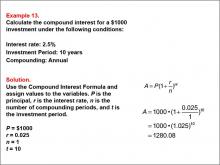

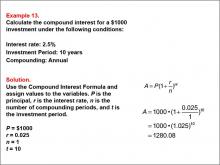

Math Example--Math of Money--Compound Interest: Example 13 | Math Example--Math of Money--Compound Interest: Example 13TopicMath of Money DescriptionThis example calculates compound interest for a $1000 investment with an interest rate of 2.5% over 10 years, compounded annually. Using the formula A = P(1 + r/n)nt, where P = 1000, r = 0.025, n = 1, and $$t = 10, the final amount is $1280.08. Understanding compound interest is crucial for financial literacy. This example demonstrates annual compounding and its effect on investment growth compared to other frequencies. By exploring various scenarios, students learn how different compounding intervals influence financial outcomes. |

Compound Interest |

|

Math Example--Math of Money--Compound Interest: Example 13 | Math Example--Math of Money--Compound Interest: Example 13TopicMath of Money DescriptionThis example calculates compound interest for a $1000 investment with an interest rate of 2.5% over 10 years, compounded annually. Using the formula A = P(1 + r/n)nt, where P = 1000, r = 0.025, n = 1, and $$t = 10, the final amount is $1280.08. Understanding compound interest is crucial for financial literacy. This example demonstrates annual compounding and its effect on investment growth compared to other frequencies. By exploring various scenarios, students learn how different compounding intervals influence financial outcomes. |

Compound Interest |

|

Math Example--Math of Money--Compound Interest: Example 13 | Math Example--Math of Money--Compound Interest: Example 13TopicMath of Money DescriptionThis example calculates compound interest for a $1000 investment with an interest rate of 2.5% over 10 years, compounded annually. Using the formula A = P(1 + r/n)nt, where P = 1000, r = 0.025, n = 1, and $$t = 10, the final amount is $1280.08. Understanding compound interest is crucial for financial literacy. This example demonstrates annual compounding and its effect on investment growth compared to other frequencies. By exploring various scenarios, students learn how different compounding intervals influence financial outcomes. |

Compound Interest |

|

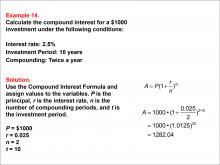

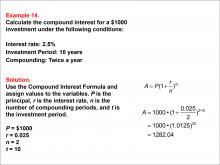

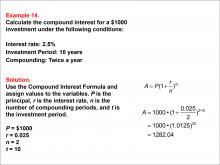

Math Example--Math of Money--Compound Interest: Example 14 | Math Example--Math of Money--Compound Interest: Example 14TopicMath of Money DescriptionThis example calculates compound interest for a $1000 investment with a 2.5% interest rate, compounded semi-annually over 10 years. Using the formula A = P(1 + r/n)nt, where P = 1000, r = 0.025, n = 2, and t = 10, the final amount is $1282.04. Understanding compound interest is essential for financial literacy. This example demonstrates semi-annual compounding and its effect on investment growth compared to other frequencies. By exploring various scenarios, students learn how different compounding intervals influence financial outcomes. |

Compound Interest |

|

Math Example--Math of Money--Compound Interest: Example 14 | Math Example--Math of Money--Compound Interest: Example 14TopicMath of Money DescriptionThis example calculates compound interest for a $1000 investment with a 2.5% interest rate, compounded semi-annually over 10 years. Using the formula A = P(1 + r/n)nt, where P = 1000, r = 0.025, n = 2, and t = 10, the final amount is $1282.04. Understanding compound interest is essential for financial literacy. This example demonstrates semi-annual compounding and its effect on investment growth compared to other frequencies. By exploring various scenarios, students learn how different compounding intervals influence financial outcomes. |

Compound Interest |

|

Math Example--Math of Money--Compound Interest: Example 14 | Math Example--Math of Money--Compound Interest: Example 14TopicMath of Money DescriptionThis example calculates compound interest for a $1000 investment with a 2.5% interest rate, compounded semi-annually over 10 years. Using the formula A = P(1 + r/n)nt, where P = 1000, r = 0.025, n = 2, and t = 10, the final amount is $1282.04. Understanding compound interest is essential for financial literacy. This example demonstrates semi-annual compounding and its effect on investment growth compared to other frequencies. By exploring various scenarios, students learn how different compounding intervals influence financial outcomes. |

Compound Interest |

|

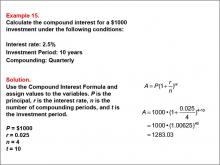

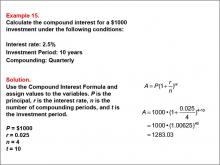

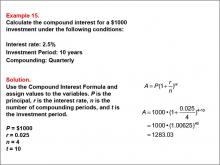

Math Example--Math of Money--Compound Interest: Example 15 | Math Example--Math of Money--Compound Interest: Example 15TopicMath of Money DescriptionThis example calculates compound interest for a $1000 investment with a 2.5% interest rate, compounded quarterly over 10 years. Using the formula A = P(1 + r/n)nt, where P = 1000, r = 0.025, n = 4, and t = 10, the final amount is $1283.03. Understanding compound interest is crucial for financial literacy. This example demonstrates quarterly compounding and its effect on investment growth compared to other frequencies. By exploring various scenarios, students learn how different compounding intervals influence financial outcomes. |

Compound Interest |

|

Math Example--Math of Money--Compound Interest: Example 15 | Math Example--Math of Money--Compound Interest: Example 15TopicMath of Money DescriptionThis example calculates compound interest for a $1000 investment with a 2.5% interest rate, compounded quarterly over 10 years. Using the formula A = P(1 + r/n)nt, where P = 1000, r = 0.025, n = 4, and t = 10, the final amount is $1283.03. Understanding compound interest is crucial for financial literacy. This example demonstrates quarterly compounding and its effect on investment growth compared to other frequencies. By exploring various scenarios, students learn how different compounding intervals influence financial outcomes. |

Compound Interest |

|

Math Example--Math of Money--Compound Interest: Example 15 | Math Example--Math of Money--Compound Interest: Example 15TopicMath of Money DescriptionThis example calculates compound interest for a $1000 investment with a 2.5% interest rate, compounded quarterly over 10 years. Using the formula A = P(1 + r/n)nt, where P = 1000, r = 0.025, n = 4, and t = 10, the final amount is $1283.03. Understanding compound interest is crucial for financial literacy. This example demonstrates quarterly compounding and its effect on investment growth compared to other frequencies. By exploring various scenarios, students learn how different compounding intervals influence financial outcomes. |

Compound Interest |

|

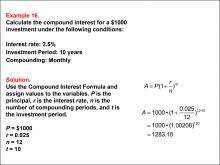

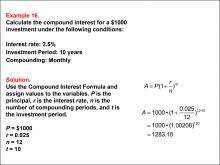

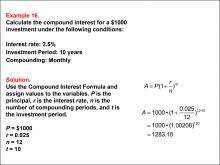

Math Example--Math of Money--Compound Interest: Example 16 | Math Example--Math of Money--Compound Interest: Example 16TopicMath of Money DescriptionThis example calculates compound interest for a $1000 investment with a 2.5% interest rate, compounded monthly over 10 years. Using the formula A = P(1 + r/n)nt, where P = 1000, r = 0.025, n = 12, and t = 10, the final amount is $1283.18. Understanding compound interest is crucial for financial literacy. This example demonstrates monthly compounding and its effect on investment growth compared to other frequencies. By exploring various scenarios, students learn how different compounding intervals influence financial outcomes. |

Compound Interest |

|

Math Example--Math of Money--Compound Interest: Example 16 | Math Example--Math of Money--Compound Interest: Example 16TopicMath of Money DescriptionThis example calculates compound interest for a $1000 investment with a 2.5% interest rate, compounded monthly over 10 years. Using the formula A = P(1 + r/n)nt, where P = 1000, r = 0.025, n = 12, and t = 10, the final amount is $1283.18. Understanding compound interest is crucial for financial literacy. This example demonstrates monthly compounding and its effect on investment growth compared to other frequencies. By exploring various scenarios, students learn how different compounding intervals influence financial outcomes. |

Compound Interest |

|

Math Example--Math of Money--Compound Interest: Example 16 | Math Example--Math of Money--Compound Interest: Example 16TopicMath of Money DescriptionThis example calculates compound interest for a $1000 investment with a 2.5% interest rate, compounded monthly over 10 years. Using the formula A = P(1 + r/n)nt, where P = 1000, r = 0.025, n = 12, and t = 10, the final amount is $1283.18. Understanding compound interest is crucial for financial literacy. This example demonstrates monthly compounding and its effect on investment growth compared to other frequencies. By exploring various scenarios, students learn how different compounding intervals influence financial outcomes. |

Compound Interest |

|

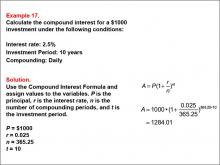

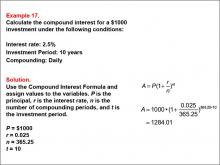

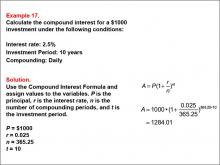

Math Example--Math of Money--Compound Interest: Example 17 | Math Example--Math of Money--Compound Interest: Example 17TopicMath of Money DescriptionThis example demonstrates compound interest calculation for a $1000 investment at a 2.5% interest rate over 10 years, compounded daily. Using the formula A = P(1 + r/n)nt, with P = 1000, r = 0.025, n = 365, and t = 10, the result is $1284.01. Understanding compound interest is essential for financial literacy. This example demonstrates daily compounding and its effect on investment growth compared to other frequencies. By exploring various scenarios, students learn how different compounding intervals influence financial outcomes. |

Compound Interest |

|

Math Example--Math of Money--Compound Interest: Example 17 | Math Example--Math of Money--Compound Interest: Example 17TopicMath of Money DescriptionThis example demonstrates compound interest calculation for a $1000 investment at a 2.5% interest rate over 10 years, compounded daily. Using the formula A = P(1 + r/n)nt, with P = 1000, r = 0.025, n = 365, and t = 10, the result is $1284.01. Understanding compound interest is essential for financial literacy. This example demonstrates daily compounding and its effect on investment growth compared to other frequencies. By exploring various scenarios, students learn how different compounding intervals influence financial outcomes. |

Compound Interest |

|

Math Example--Math of Money--Compound Interest: Example 17 | Math Example--Math of Money--Compound Interest: Example 17TopicMath of Money DescriptionThis example demonstrates compound interest calculation for a $1000 investment at a 2.5% interest rate over 10 years, compounded daily. Using the formula A = P(1 + r/n)nt, with P = 1000, r = 0.025, n = 365, and t = 10, the result is $1284.01. Understanding compound interest is essential for financial literacy. This example demonstrates daily compounding and its effect on investment growth compared to other frequencies. By exploring various scenarios, students learn how different compounding intervals influence financial outcomes. |

Compound Interest |

|

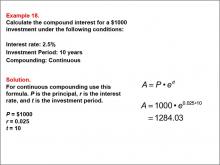

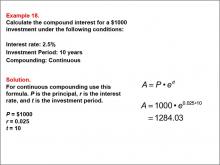

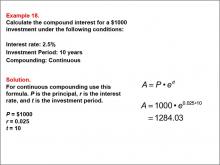

Math Example--Math of Money--Compound Interest: Example 18 | Math Example--Math of Money--Compound Interest: Example 18TopicMath of Money DescriptionThis example illustrates compound interest for a $1000 investment at a 2.5% interest rate over 10 years with continuous compounding. The formula for continuous compounding is A = Pert. With P = 1000, r = 0.025, and t = 10, the amount is calculated as $1284.03. Understanding compound interest is crucial for financial literacy. This example demonstrates continuous compounding and its effect on investment growth compared to other frequencies. By exploring various scenarios, students learn how different compounding intervals influence financial outcomes. |

Compound Interest |

|

Math Example--Math of Money--Compound Interest: Example 18 | Math Example--Math of Money--Compound Interest: Example 18TopicMath of Money DescriptionThis example illustrates compound interest for a $1000 investment at a 2.5% interest rate over 10 years with continuous compounding. The formula for continuous compounding is A = Pert. With P = 1000, r = 0.025, and t = 10, the amount is calculated as $1284.03. Understanding compound interest is crucial for financial literacy. This example demonstrates continuous compounding and its effect on investment growth compared to other frequencies. By exploring various scenarios, students learn how different compounding intervals influence financial outcomes. |

Compound Interest |

|

Math Example--Math of Money--Compound Interest: Example 18 | Math Example--Math of Money--Compound Interest: Example 18TopicMath of Money DescriptionThis example illustrates compound interest for a $1000 investment at a 2.5% interest rate over 10 years with continuous compounding. The formula for continuous compounding is A = Pert. With P = 1000, r = 0.025, and t = 10, the amount is calculated as $1284.03. Understanding compound interest is crucial for financial literacy. This example demonstrates continuous compounding and its effect on investment growth compared to other frequencies. By exploring various scenarios, students learn how different compounding intervals influence financial outcomes. |

Compound Interest |

|

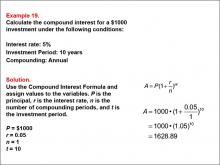

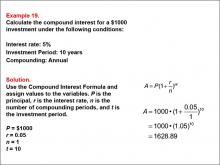

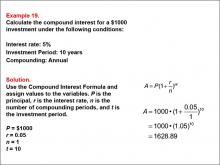

Math Example--Math of Money--Compound Interest: Example 19 | Math Example--Math of Money--Compound Interest: Example 19TopicMath of Money DescriptionThis example shows how to calculate compound interest for a $1000 investment with a 5% annual interest rate over 10 years, compounded annually. The formula used is A = P(1 + r/n)nt. Given P = 1000, r = 0.05, n = 1, and t = 10, the calculation yields $1628.89. Understanding compound interest is essential for financial literacy. This example demonstrates annual compounding and its effect on investment growth compared to other frequencies. By exploring various scenarios, students learn how different compounding intervals influence financial outcomes. |

Compound Interest |

|

Math Example--Math of Money--Compound Interest: Example 19 | Math Example--Math of Money--Compound Interest: Example 19TopicMath of Money DescriptionThis example shows how to calculate compound interest for a $1000 investment with a 5% annual interest rate over 10 years, compounded annually. The formula used is A = P(1 + r/n)nt. Given P = 1000, r = 0.05, n = 1, and t = 10, the calculation yields $1628.89. Understanding compound interest is essential for financial literacy. This example demonstrates annual compounding and its effect on investment growth compared to other frequencies. By exploring various scenarios, students learn how different compounding intervals influence financial outcomes. |

Compound Interest |

|

Math Example--Math of Money--Compound Interest: Example 19 | Math Example--Math of Money--Compound Interest: Example 19TopicMath of Money DescriptionThis example shows how to calculate compound interest for a $1000 investment with a 5% annual interest rate over 10 years, compounded annually. The formula used is A = P(1 + r/n)nt. Given P = 1000, r = 0.05, n = 1, and t = 10, the calculation yields $1628.89. Understanding compound interest is essential for financial literacy. This example demonstrates annual compounding and its effect on investment growth compared to other frequencies. By exploring various scenarios, students learn how different compounding intervals influence financial outcomes. |

Compound Interest |

|

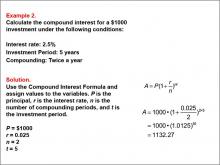

Math Example--Math of Money--Compound Interest: Example 2 | Math Example--Math of Money--Compound Interest: Example 2TopicMath of Money DescriptionThis example illustrates the calculation of compound interest for a $1000 investment at a 2.5% interest rate over 5 years, compounded semi-annually. The formula A = P(1 + r/n)nt is applied with P = 1000, r = 0.025, n = 2, and t = 5. The final amount after 5 years is $1132.27. |

Compound Interest |

|

Math Example--Math of Money--Compound Interest: Example 2 | Math Example--Math of Money--Compound Interest: Example 2TopicMath of Money DescriptionThis example illustrates the calculation of compound interest for a $1000 investment at a 2.5% interest rate over 5 years, compounded semi-annually. The formula A = P(1 + r/n)nt is applied with P = 1000, r = 0.025, n = 2, and t = 5. The final amount after 5 years is $1132.27. |

Compound Interest |

|

Math Example--Math of Money--Compound Interest: Example 2 | Math Example--Math of Money--Compound Interest: Example 2TopicMath of Money DescriptionThis example illustrates the calculation of compound interest for a $1000 investment at a 2.5% interest rate over 5 years, compounded semi-annually. The formula A = P(1 + r/n)nt is applied with P = 1000, r = 0.025, n = 2, and t = 5. The final amount after 5 years is $1132.27. |

Compound Interest |

|

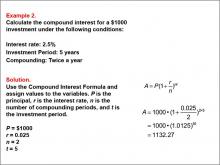

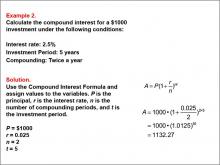

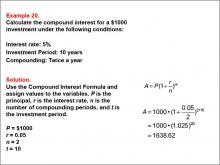

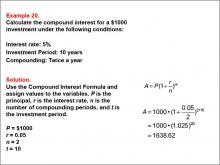

Math Example--Math of Money--Compound Interest: Example 20 | Math Example--Math of Money--Compound Interest: Example 20TopicMath of Money DescriptionThis example calculates compound interest for a $1000 investment with a 5% interest rate, compounded twice a year over 10 years. The formula used is A = P(1 + r/n)nt. Given P = 1000, r = 0.05, n = 2, and t = 10, the calculation results in $1638.62. Understanding compound interest is crucial for financial literacy. This example demonstrates semi-annual compounding and its effect on investment growth compared to other frequencies. By exploring various scenarios, students learn how different compounding intervals influence financial outcomes. |

Compound Interest |

|

Math Example--Math of Money--Compound Interest: Example 20 | Math Example--Math of Money--Compound Interest: Example 20TopicMath of Money DescriptionThis example calculates compound interest for a $1000 investment with a 5% interest rate, compounded twice a year over 10 years. The formula used is A = P(1 + r/n)nt. Given P = 1000, r = 0.05, n = 2, and t = 10, the calculation results in $1638.62. Understanding compound interest is crucial for financial literacy. This example demonstrates semi-annual compounding and its effect on investment growth compared to other frequencies. By exploring various scenarios, students learn how different compounding intervals influence financial outcomes. |

Compound Interest |